Real Hourly Earnings Calculator Calculate Your Wages After Work Expenses

Increase Real Wage with Practical Budgeting

Published October 4, 2019 by Benjie Sambas

Most people live from paycheck to paycheck. Factors like costs of living and inflation decrease the purchasing power of today’s income, though it is far from what it was years ago. Workers need to know their real hourly earnings and actual income to gauge their true financial health.

How wages changed over time

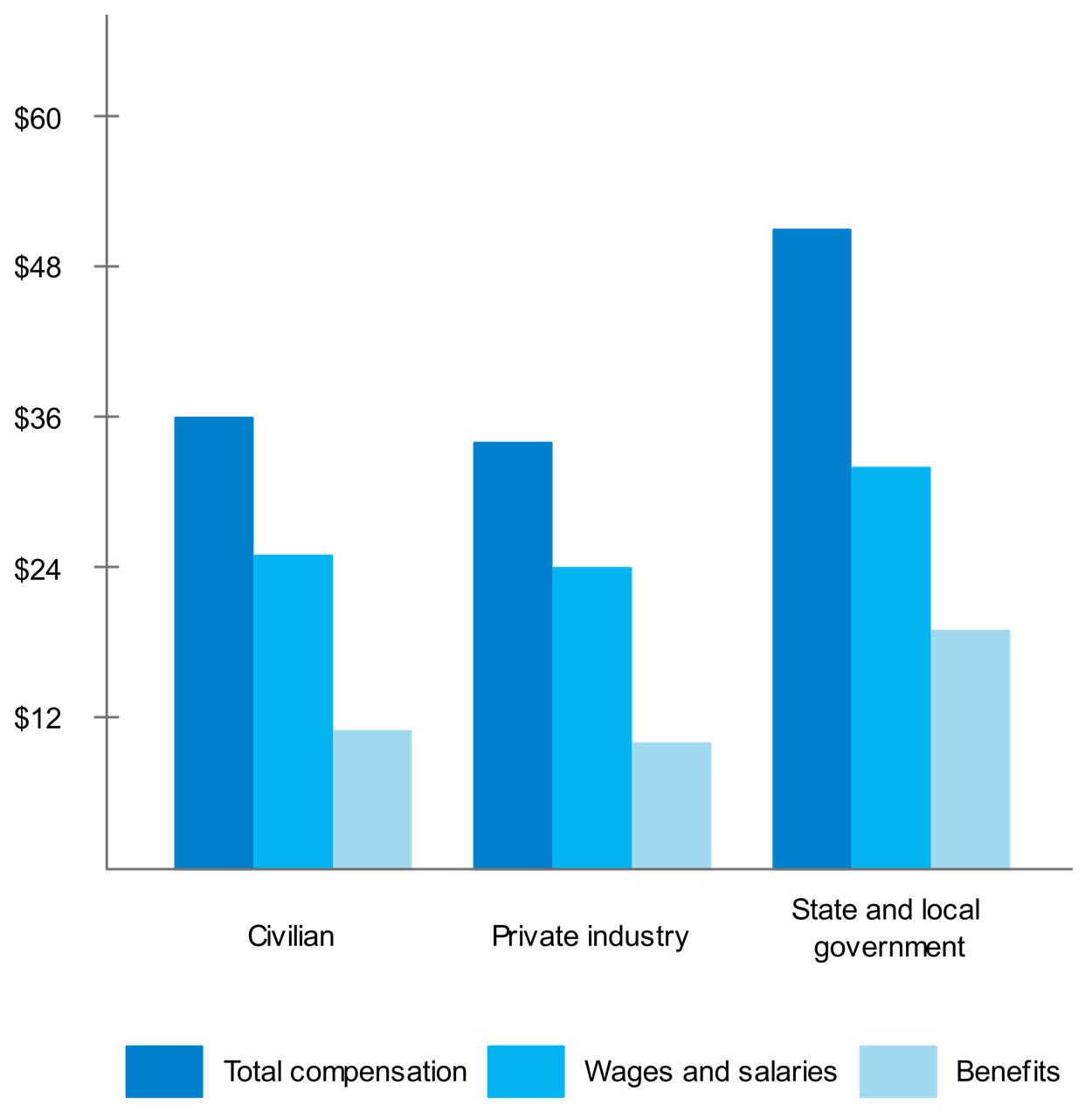

Wage has been stable recently that increases in compensation are happening across industries. According to the Bureau of Labor Statistics, wages and salaries across all types of employees rose by 0.7%, and the upward trend continues. Total compensation also includes other benefits like health plans, pensions, and allowances. However, wages and salaries still comprise about 70% of the total employee compensation.

Employee total compensation per hour worked

Meanwhile, although there are incremental increases in salaries and wages, most employees should take note of wage growth. This is the one of the metrics that financial experts use to be as close to a true rate as possible. This is important in measuring cost- and income-related factors like real earnings for individuals.

In case of wage growth, the Atlanta Fed uses nominal wage growth and has its own tracker. Accordingly, the agency has posited that the continued growth will mean better standard of living for workers. Speaking about the upwards trend, Atlanta Fed President Loretta Mester is positive that wages are on their way to recovery.

“Aggregate measures of compensation are now in the 3 percent range, after being quite subdued earlier in the expansion. This is a welcome increase. It gives workers more purchasing power, but because the pickup has been in line with productivity growth and inflation, it has not added to inflationary pressures.”

Loretta J. Mester, President and Chief Executive Officer, Cleveland Fed

However, there are factors that can diminish wage growth, especially when it comes to expenses and savings.

Indirectly proportional

Inflation and purchasing power affect real income, and these two are indirectly proportional. When the former increases, the latter drops. Because of inflation, a cup of coffee for $1.25 in 2017 will cost $1.67 in 2018.

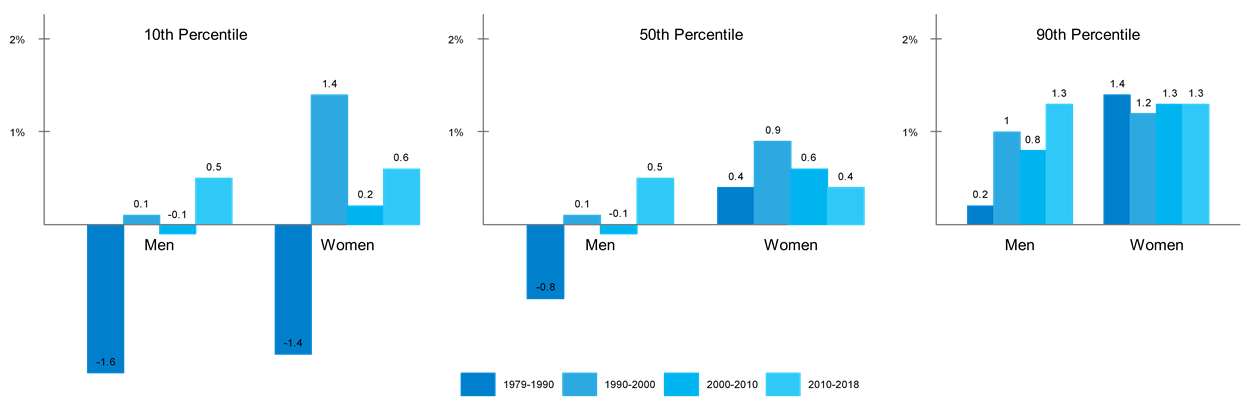

Real wage is the amount after accounting for inflation. The value of the amount is its purchasing power. Economic observers say that the real average wage of employees has about the same purchasing power as wages from 40 years ago. This means that even with wage increases, purchasing power mostly remained stagnant. Meanwhile, annualized data also suggests that wage growth is largely concentrated on the upper income bracket.

Annualized real wage growth from 1979-2018

Other factors for decreasing worth

Inflation is the primary reason that drives prices up, though there are still other factors that can account for the continuing decrease of purchasing power. For example, if most of your expenses focus on healthcare, your income’s purchasing power will further decrease. Healthcare prices increase by up to 2.5% per year on top on the yearly inflation.

The Consumer Price Index (CPI)

Standards like CPI help measure the real value of a worker’s income. The Consumer Price Index is the mark that financial experts use to measure how inflation of deflation (or negative inflation, when inflation decreases past zero) affect purchasing power.

Why is CPI a factor in determining your real earnings? This index measures costs on at least eight major, everyday expenses:

- Housing

- Food and beverages

- Education and communication

- Medical care

- Transportation

- Clothes

- Recreation

- Other goods and services

Meanwhile, the CPI also takes into account other costs and expenses like government-charged fees, registration fees, vehicle tolls, and sales and excise tax on purchases. The index doesn’t include income and Social Security taxes.

This means that “real earnings” come from net income and should be already adjusted for inflation. However, even taking inflation, CPI, and other standards into account, “real” earnings have yet to reflect true income for an employee.

Paychecks are not real earnings

Most people are familiar with the idea that their income after taxes and deductions is their earnings from work. However, take-home pays are nowhere near as close to the amount that employees think they’ve worked for.

For example, your take-home pay will continue to decrease its buying power if you break down your wage as real hourly earnings. Most people only account for the time they spent at the office as part of their income. However, to evaluate your true hourly earnings, you need to consider every expense towards work.

Evaluating income as true earnings by the hour, you need to factor in money, time, and effort spent towards work. You will need to consider fuel and transportation expenses, food, the time it took to get to work, and other work-related components.

This means that your average $17 per hour minus taxes is not your real income if you factor in other costs, further decreasing your buying power.

Calculations may be too complex considering there are many factors that influence true income. However, there are online calculators and apps available that can automatically formulate real hourly earnings for you.

Increase real wage with practical budgeting

Since real hourly earnings are much lesser than the actual expected income, one common advice to increase its purchasing power is to add more income. However, there are also practical, easily doable considerations in budgeting that can add to your wage’s real value aside from generating more income.

Think in terms of work hours.

Instead of looking at price tags, calculate how long you need to work for to purchase something. This works especially if you already know your real hourly earnings. Making yourself aware that you need to work longer hours to buy something you want will likely make you think twice before buying it. It will help avoid impulse buys and unnecessary purchases.

Reduce taxable income.

Aside from making more and adding to your hourly rate, decreasing your taxable income also works towards increasing real wage. There are federal and state taxes that may apply to your income. Reduce your taxable salary by opening flexible spending accounts. You can also match your employer’s 401(k) contributions, or enroll in health insurance. All these options offer tax advantages that adds to your income’s purchasing power by increasing your true take-home pay.

Sign up for retirement accounts.

If you’re yet to qualify for employer-matching funds, consider getting an IRA. These accounts work both as retirement and long-term emergency funds. While this may not increase your real hourly rates, it will help you prepare for more comfortable post-work income in your retirement. Meanwhile, there is a new account called Roth IRA that uses after-tax contributions. This means all distributions on your retirement will have tax incentives.

Set up a budget and stick to it.

Planning where your income goes is one of the more basic concepts to optimize earnings. However, most employees do away with budgets and continue to live from paycheck to paycheck. Outline all your expenses and allocate your income. Make sure to prioritize savings. Sticking to your budget helps avoid unnecessary expenses and helps manage a fluid cash flow.

Cut off unnecessary expenditure.

There are little expenses you can do without and can mean more earnings. Evaluate if you really need those daily coffee runs, cold beers after work, eating out every weekend, and other costs. Most often, cutting back on these little expenses go a long way towards adding to your real earnings.

Consider passive income.

Invest your time or earnings and start a passive income stream. This type of income will earn by itself over time. This is especially useful for those who don’t the time for a second job. Consider a blog, YouTube tutorials, affiliate marketing, or other income-generating activities to boost your income.

Maximize your real hourly earnings

The amount you make at work is not the real worth of your income. Aside from taxes and other mandated deductions, your take-home pay should also take into account other work-related expenses like transportation and commuting costs, food expenses, as well as the time and effort it took to get to and from work. Considering all these factors equals your real earnings.

Meanwhile, since real hourly earnings likely decreased because of additional expenses, one can either get new income to increase real wages. However, there are also other options like practical budgeting that one can do to further maximize real earnings.