Biweekly Home Loan Calculator Estimate Your Savings

Can You Save by Paying Mortgage Biweekly?

Published September 1, 2019 by Benjie Sambas

One of the most familiar things you can likely relate to is budgeting a month's worth of expenses, with mortgage payment eating most of your income. However, did you know there maybe a thing or two you can do to pay for your amortizations and save at the same time?

Why are mortgages a monthly expense?

This may sound familiar: at the first of the month, you are already calculating how much budget you'll have and make ends meet for at least thirty days. However, you only have enough money to cover for your mortgage payments, and you'd need extra for most of your needs. Bad news, though – the next paycheck won't come for at least two weeks.

It's a familiar scene for most employees. According to statistical data by the US Department of Labor, a semi-monthly salary arrangement is the most common among businesses. Biweekly salaries account for more than a third, followed closely by employers paying their employees on a weekly basis.

However, although you are likely getting paid twice each month, it's hard making ends meet especially for expenses like mortgage payments, which takes a significant portion of your monthly budget.

Why are mortgages a monthly expense? Usually, lending institutions get this schedule as the default. This means that all the costs that come with the principal – the main amount for your amortization – such as interest, property taxes, and coverage like homeowner's and mortgage insurance, are being paid for all at once each month. Depending on the loan terms, paying for your monthly mortgage may seem overwhelming.

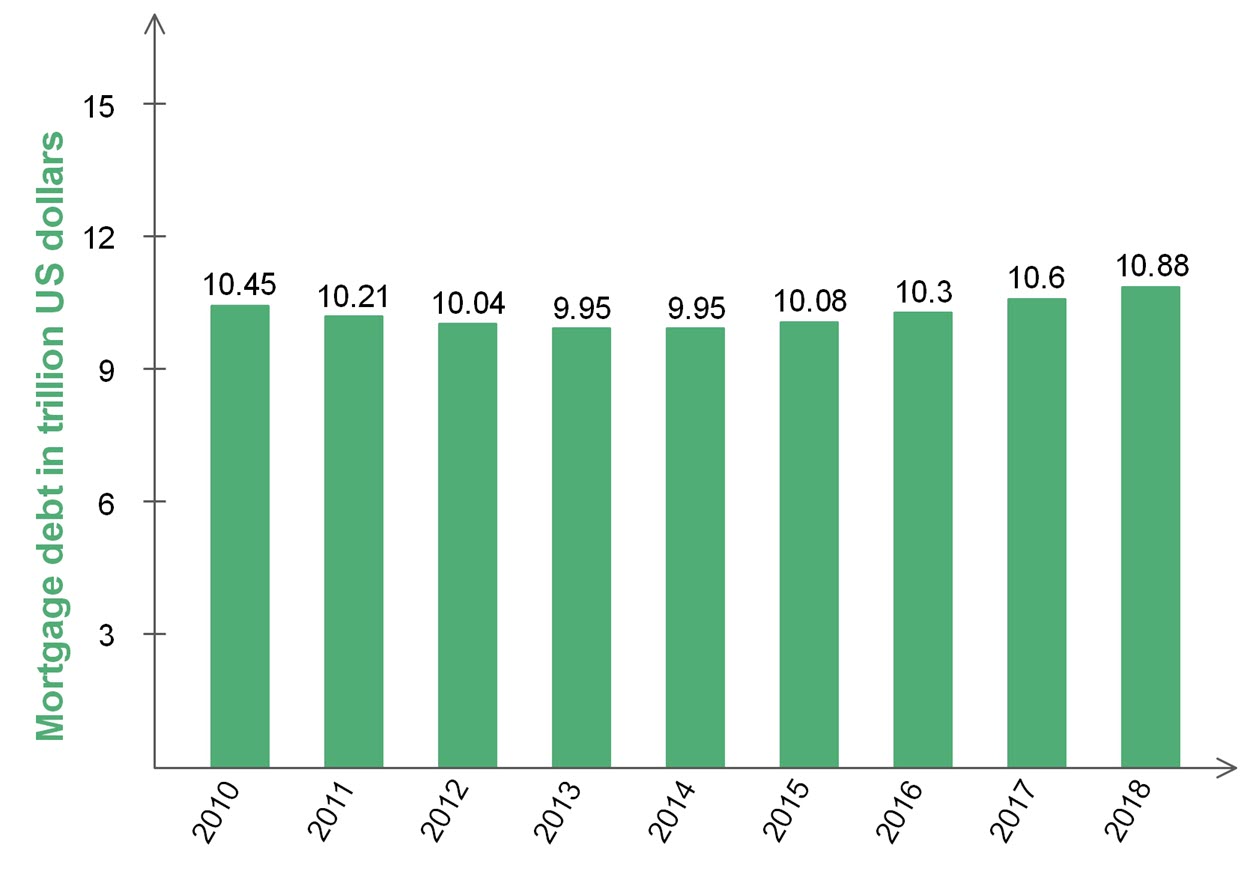

The total mortgage debt outstanding on one-to-four-family residences amounted to approximately 10.88 trillion US dollars in the United States in 2018. (From the United States Federal Reserve; 2001 to 2018, one-to-four-family residences, data as of end Q4)

The total mortgage debt outstanding on one-to-four-family residences amounted to approximately 10.88 trillion US dollars in the United States in 2018. (From the United States Federal Reserve; 2001 to 2018, one-to-four-family residences, data as of end Q4)Most households find mortgage payments too much of a burden. In the United States, the outstanding mortgage debt for 1-to-4 family residences has steadily increased in recent years. This is not surprising, given that the average cost for new homes increased by as much as 46% over the past 10 years.

However, although mortgage debt numbers are steadily increasing since most homeowners are likely leveraging their finances, most mortgages are updated in terms of payments. Delinquency rates are decreasing, which means that most loan takers are able to make their scheduled amortizations.

Delinquency Rates as Percentage of Mortgage Balance

| Number of Days Late | 2016 | 2018 | 2019 |

|---|---|---|---|

| 30-59 | 1.18% | 1.03% | 1.07% |

| 60-89 | 0.46% | 0.41% | 0.36% |

| 90-180 | 0.72% | 0.52% | 0.46% |

Delinquent payments that were late for more than 30 days but less than 60 have decreased by as much as 61% since 2009. (Data from Experian, for Q1 each year)

Biweekly payments = savings?

Since your income probably comes at least every other week, why not split the mortgage payments, too? Some homeowners have opted for biweekly payments on their loans, and most agree that it can lead to savings, as well as a number of other advantages toward paying off the mortgage.

How can you save by paying your mortgage at least every other week?

The hidden, helpful payment

According to finance observers, biweekly mortgage payments mean that you'll get to pay at least 26 times each year. Instead of making 12 amortizations annually, you get to pay the equivalent of 13 monthly payments. This means that there is an extra month, which can account for paying off your mortgage much earlier.

For example, you opted for a mortgage on a house worth $200,000. With $40,000 or at least 20 percent out of the way as down payment, you'd need to secure $160,000 for your loan. With a 30-year term at 4.375 fixed mortgage rate, the total amount you'll need to pay is $287,588.31 for a regular per-month amortization.

However, you can save much by paying for your mortgage every other week.

| Payment Type | Monthly P&I | Biweekly P&I |

|---|---|---|

| Payment amount | $798.86 | $399.43 |

| Payments per year | 12 | 26 |

| Number of years | 30 | 26 years |

| Total payment | $287,588.31 | $266,316.39 |

| Total interest paid | $127,588.31 | $106,316.39 |

In the example above, there is significant savings when you schedule biweekly mortgage payments, as you can save $21,271.92. Meanwhile, since there are at least an extra month for biweekly payments, you also get to pay off your loan at least three years earlier than the agreed-on term.

Pros of biweekly payments

Aside from the significant savings when paying off your mortgage, how are biweekly payments a huge help for loan takers?

Build equity faster

When you pay off your loan much earlier than the given term, you get to have your home equity solidly built. Home equity is the amount of your home that you actually own, and is commonly mistaken by beginners to be one hundred percent once the house has been turned over. Realistically, how much down payment you paid for at the start is your initial home equity, and builds up over time as you pay your amortizations. Having higher home equity has its own advantages, such as higher chances of being granted home equity loans. In addition, with high home equity, there would be minimal expenses for other charges like closing costs when you choose to sell your home.

Cancel PMI sooner

Private mortgage insurance (PMI) is a given, since it protects your lender against defaulted loans. PMI can only be removed from your monthly amortizations when you make at least a 20-percent down payment, which for most first-time loan takers is already a significant amount. However, you can also have the PMI cancelled when you reach at least 20 percent on your home equity. This means that making biweekly mortgage payments make you reach that target faster.

Easier, convenient budgeting

Most loan takers grumble when it comes to monthly amortizations, since it takes a huge chunk out of the monthly budget. Paying off your mortgage through biweekly payments means that you'll most probably find it easier to budget on things, especially since income checks come in on almost the same schedule, so most of your expenses will likely be in sync with your income. This also makes you more reliable to your lender, since they are also familiar with a biweekly salary schedule. With a good payment schedule laid out, lenders will know that you're unlikely to miss a payment.

Downsides

It seems like making biweekly mortgage payments is the way to go, but there are some who are wary of using this method to save on mortgages.

You'd likely lose money if you pay for the service

Since most lenders follow default payment terms, this means that most financing options only allow for monthly payments. While there are third-party services you can use to set up biweekly mortgage payments, some of the cash you intended to save will probably be used for service charges and setup fees.

You should not need to use a third party service which charges fees to make your payments biweekly. Speak with your bank to see if you can automate the process. Many banks offer automated payment plans through their online interfaces which allow you to move money between accounts or pay fees automatically on a preset schedule.

More payments may mean tighter budget

Since you've cut your monthly amortization into two, it means that the new payment will eat up the budget intended for other expenses. When you've regularly budgeted your amortizations on your last-month paycheck, cutting it into biweekly payments mean an added cost for your mid-month income, which makes budgeting for your other expenses a tricky exercise.

There may be prepayment penalties

Since monthly payments are most common, some lenders may charge extra if you pay early, especially if they don't have biweekly mortgage payment options available. According to the Consumer Financial Protection Bureau though, prepayment penalties are more commonly applied when a loan taker pays off the entire mortgage balance within a specific number of years. However, the safest route is to ask your lender about charges for early payments on mortgages.

Can you DIY?

Since getting the services of third-party companies with biweekly payment options means extra payment, one way to fully take advantage of the benefits is to know and schedule mortgage payments every other week yourself. Check out this bi-weekly mortgage payment calculator to know how much you'd likely pay for a biweekly mortgage payment schedule.

Aside from scheduling mortgage payments every other week, there are no complicated steps needed, so even first-time borrowers can easily do this method. However, as with regular payment schedules, you need to make sure that your amortizations get credited as soon as they are made, and that your payments should always be on time.

The above calculator is based on the principal & interest portion of your payment. Keep in mind you will also need to pay at least the pro-rated portion of your other monthly mortgage-related expenses including property taxes, HOA fees & homeowners insurance. If these payments are typically included in your mortgage payment then if you pay half of them in each biweekly period with the extra being applied to the loan's principal you will pay off the loan even faster.

Save some More

Aside from making biweekly payments on your mortgage, there are other ideas you can do to to pay off your mortgage much earlier, and get more savings while doing so.

- Keen budget-makers advise that borrowers need to have a separate account for mortgage payments. While this may seem insignificant (or inconvenient, as you have to open another account), separating the accounts for mortgage from other expenses is sound practice. While mortgage payment schedules are inflexible, you can usually re-schedule payments for other expenses. This will also make keeping track of payment schedules more convenient.

- Get into the habit of making extra payments against the principal. When you receive bonuses or a third paycheck, make sure that you make extra payments on your mortgage, and that the payment is applied to the principal. Making direct payments to the principal mean that your home equity will increase, and your mortgage interests will lessen.

- Invest. Instead of making extra payments on loans, some invest the money otherwise saved on making regular mortgage payments. There are investment opportunities that can give you high returns with medium to low risks, like mutual funds, 401(k), and Roth IRA. However, investments usually mean long-term savings, and may sacrifice liquidity. Also, the hurdle rate on investments is above the rate of interest on your mortgage as investment income is taxed whereas interest savings are not.

- Refinance with shorter terms. Most first-time borrowers take out a 30-year loan because it is the most affordable. However, when you can regularly pay extra, refinancing your home with a shorter term is another option. Most reduced terms also come with lower interest rates, especially if you've already made a significant amount in paying off the original principal. The 15-year mortgage is a popular choice among refinancers.

Wrapping it up

Paying off your mortgage earlier through biweekly payments works best if you don't have other loans or outstanding debts. Meanwhile, if you do find that your lender has a biweekly payment option, make sure that the payments are credited as soon as they are received; waiting for the full payment before sending it out defeats the purpose of making biweekly mortgage payments. In addition, you should make sure that early or additional payments are credited against the principal so you can enjoy significant savings.

About the Author

Benjie has been a bookwork for decades. He believes that writing is a form of expression, and that connecting with readers means you’ve expressed yourself correctly. Writing mostly on tech and social media topics, he continues to win over readers across other areas, too – both to inform and engage. His works have appeared in news publications like Christian Today & on business sites like Freelancer.com.

When taking a break from writing, you’ll most likely come across Benjie in a quiet corner of a room browsing an eBook by Robert Kiyosaki or Napoleon Hill, or reading the latest from Tom Clancy or WEB Griffin. In his spare time he enjoys urban trekking & photography.