Average Interest Rate Calculate Your Blended Interest Rates Across Your Debts

Starting a Practical Payment Plan with a Debt List

Published September 13, 2019 by Benjie Sambas

Consumer debt has breached the $10-trillion mark. The Federal Reserve updates that household debt is already at $13.86 trillion by the second quarter of 2019. This debt combines household and financial obligations like mortgage and credit card balances, student and auto loans, and other personal liabilities.

Although the economy continues to recover, many are still struggling to climb out of debt, especially those who have already dug themselves too deep. A practical payment plan is one method to get out of debt faster.

Fast facts on debt

Financial obligations are a part of life especially for an average household with tight budgets. Debt adds to the already-strained expenditure. If not properly managed, too much obligations can lead to a spiral and even bankruptcy.

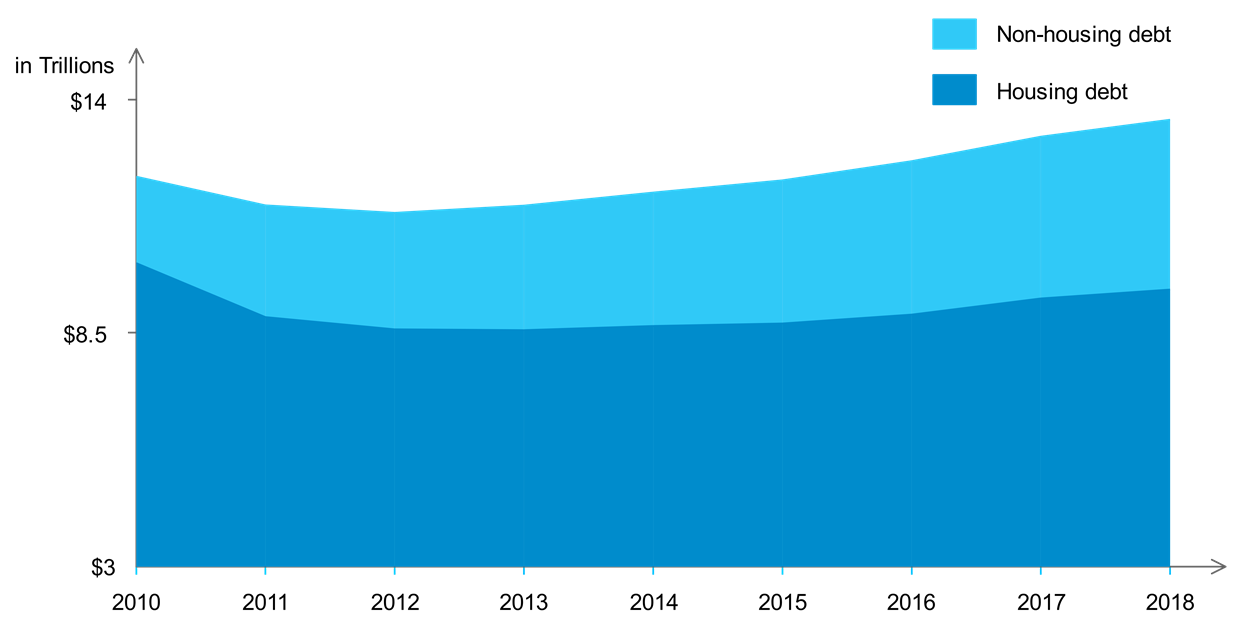

According to the New York Fed, the largest factor for household debt is housing. Mortgage balances account for more than half of the total consumer debt balance. In 2019, housing debt is at $9.81 trillion, against non-housing obligations at $4.06 trillion.

Total debt balance in recent years

Housing obligations like mortgages continue to have the largest share out of the total household debt balance in recent years. Non-housing balances like credit card dues and auto loans also increased. (New York Fed)

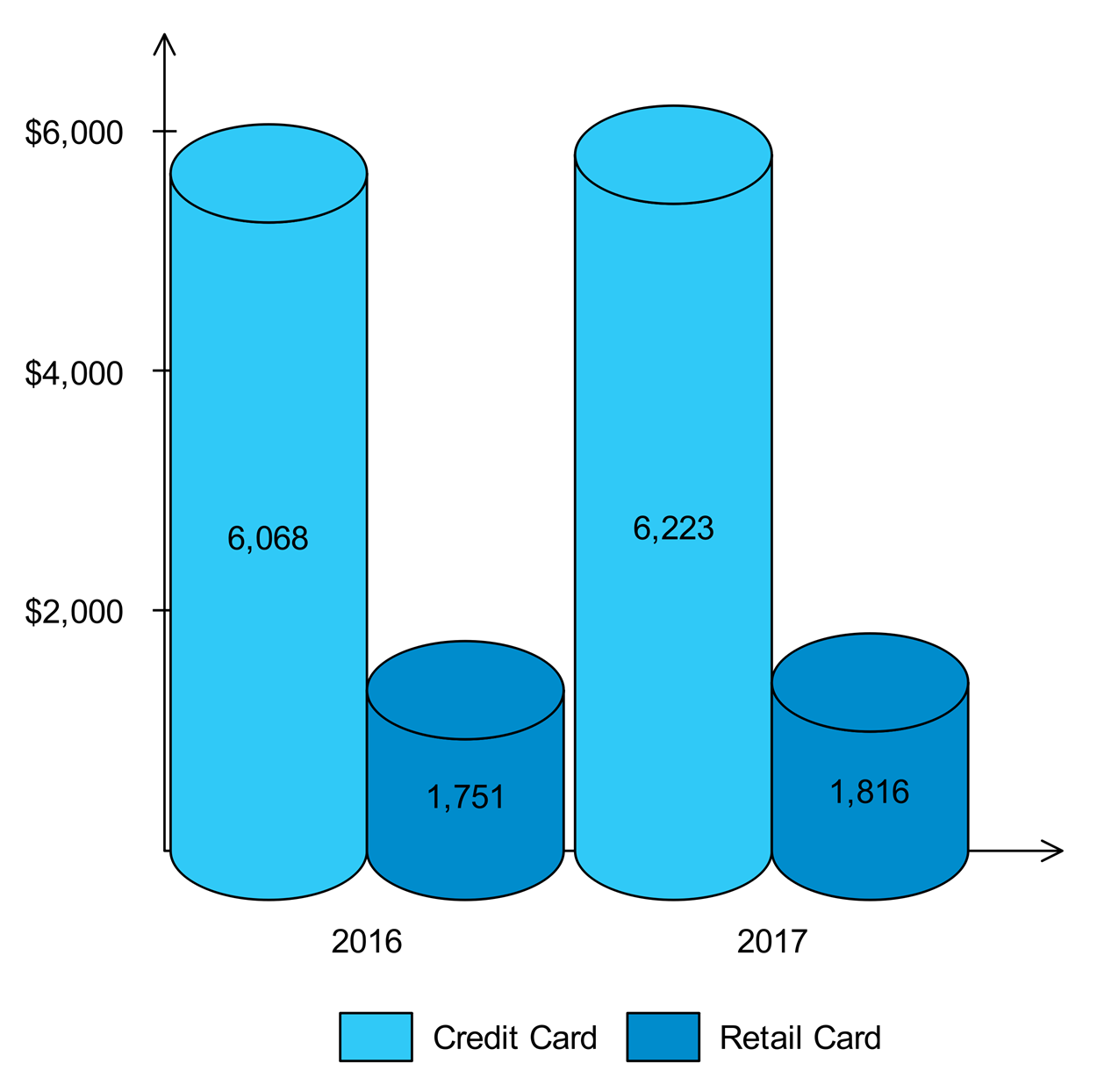

Housing obligations like mortgages continue to have the largest share out of the total household debt balance in recent years. Non-housing balances like credit card dues and auto loans also increased. (New York Fed)Out of non-housing debt, the biggest contributors to financial obligations are revolving debt like credit card balances. Recent figures in 2017 show the average credit card debt rising by 2.7% for a $6,223-average balance. Retail card debt is also on the rise.

Average debt for credit and retail cards

In 2017, credit card debt surpassed $1 trillion for the first time since the Great Recession, according to the Federal Reserve. Among all age groups, it was found out that people carry an average of $6,223 balance on their credit cards. (Experian)

In 2017, credit card debt surpassed $1 trillion for the first time since the Great Recession, according to the Federal Reserve. Among all age groups, it was found out that people carry an average of $6,223 balance on their credit cards. (Experian)Aside from card balances, other obligations that contribute to high debt include student loans, medical fees, and other arrears like payday and auto loans.

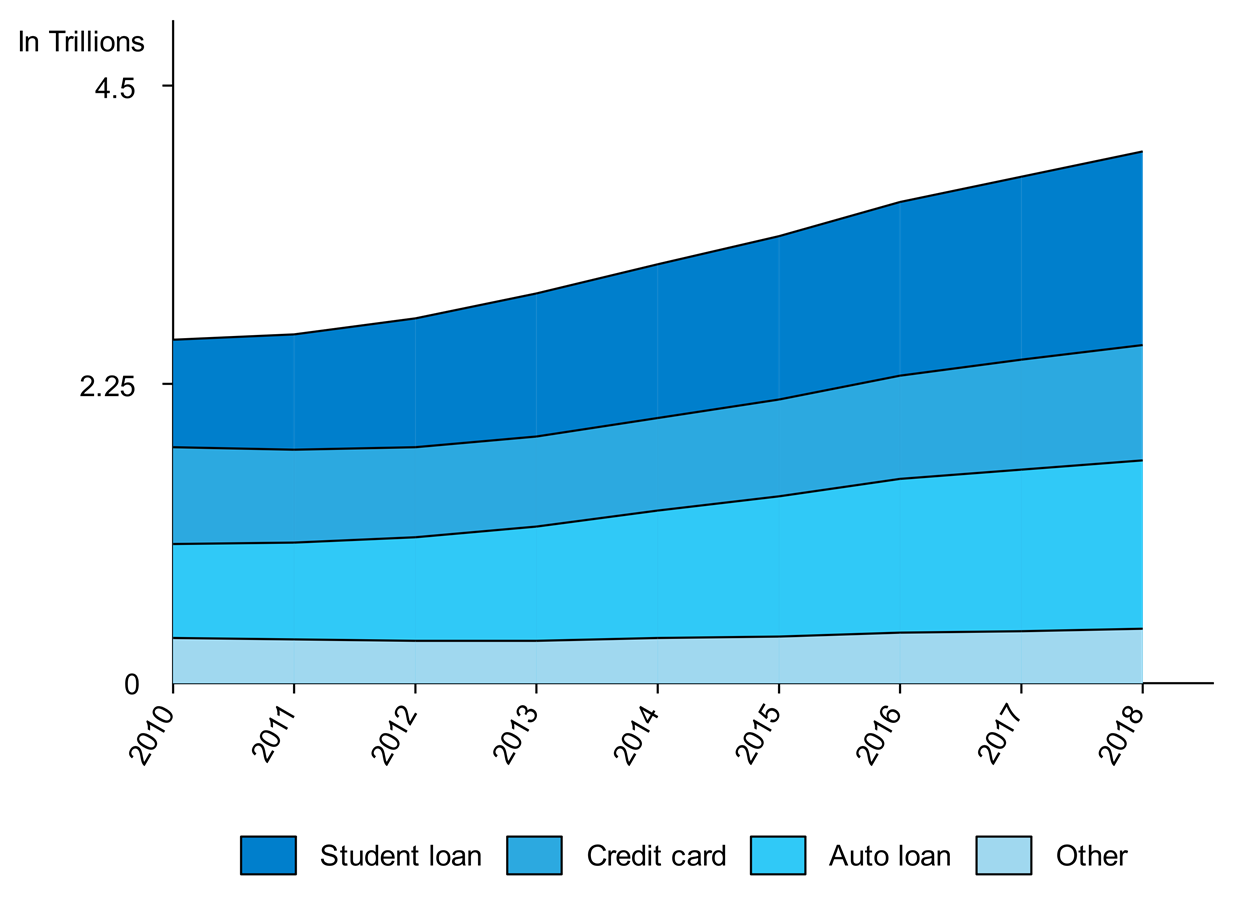

Non-housing debt balance in recent years

The non-housing debt balance in recent years. A large portion of this balance is from auto loans and student debt. (New York Fed)

The non-housing debt balance in recent years. A large portion of this balance is from auto loans and student debt. (New York Fed)

Why does debt balloon to uncontrollable figures?

The reality of debt

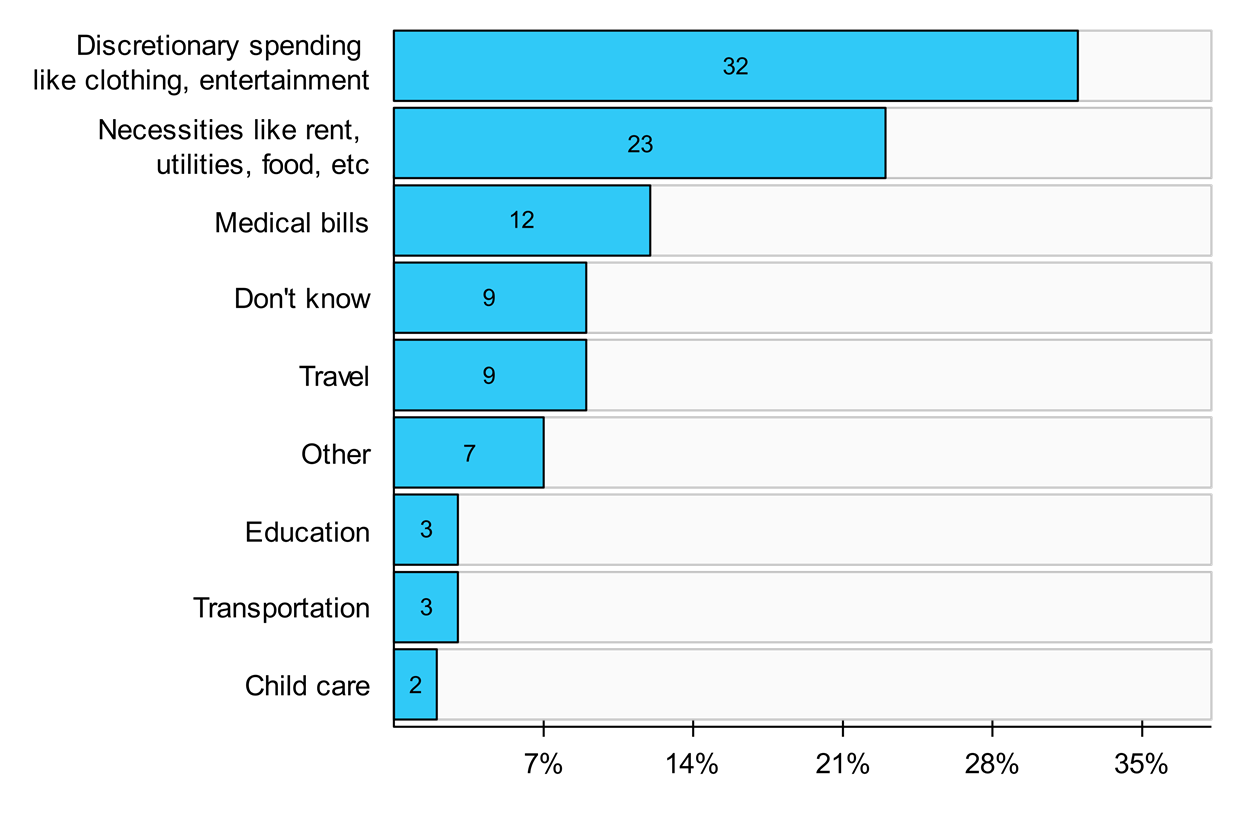

Although expenses on necessities and paying for obligations do lead to debt, it’s not the main cause why people owe too much. Unsurprisingly, a report by CNBC points to reckless spending as one of the main causes. In a survey, it mentions how “discretionary” spending on clothes, entertainment, etc. takes more than 30% of an average person’s credit card debt. Combine it with other expenses like basic necessities and financial obligations and a person’s average monthly debt will keep on increasing.

A survey of how people budget their income

Most people like to have “discretionary spending” on mostly wants like clothing and entertainment. Needs like basic necessities are only the second-highest priority among those asked in a survey.

Most people like to have “discretionary spending” on mostly wants like clothing and entertainment. Needs like basic necessities are only the second-highest priority among those asked in a survey.Aside from bloated expenses due to reckless spending, everyday budget struggle also contributes to collecting debt. A study by Pew Research states that while the economy is recovering, the purchasing power of an average household remains the same as it was 40 years ago. This is in the face of rising costs for basic expenditure like medical bills, food, utilities, and such.

This disconnect in the system is hugely responsible for household hardships, according to Alissa Quart, executive director of the Economic Hardship Reporting Project.

“Stop blaming yourself and start blaming the system, or start blaming the deeper causes of your economic fragility and instability. There are forces that are constructed against you, everything from your taxes to whether you can have job security.”

Alissa Quart, Economic Hardship Reporting Project

Managing debt with a payment plan

Although the system is partly to blame for debt, it is still a personal responsibility. It also means that you can manage debt and avoid getting into too many obligations. If handled the right way, one can get out of debt spiral and possible bankruptcy.

One of the best ways to manage and get out of debt is a practical payment plan.

Starting a practical payment plan

A practical payment plan starts with knowing what debt you have based on when you need to pay for them.

- Current. These are obligations which are promptly paid. Usually, these include basic necessities as they should be settled on schedule. There are also debt that should be paid on time like high-interest cards.

- Past due. Since the average person has 2-3 cards, most get the idea of carrying balances over until the next pay period, so the original balances are now past due for at least 30 days. Other obligations that may not get high priority for payments are payday loans, medical bills, and other debt that may have a “grace period.”

- Defaulted. These are debt that are past due for more than 90 days. Among financial obligations, mortgage payments usually get defaulted especially when the income decreases, since utilities and other arrears needed to be paid first.

Generally, obligations balloon out of proportion because they are not met accordingly. Late fees, charges, and penalties add to already-strained burden of having debt.

Creating a list

Keeping track of your debt is also a great start towards paying obligations and managing debt. Details such as what debt it is, remaining balance, and interest rates are important so you can take note of which debt to prioritize. The total debt and average interest rate should also be listed.

While due dates are important, they are typically not prioritized in debt management plans. Most likely, the debt ballooned because most obligations are already past due or have defaulted. They are only listed to organize the payment schedule.

An example of a debt list

| Debt | Balance Owed | Minimum Payment |

|---|---|---|

| Mortgage | $170,000 | $1,300 |

| Credit Card 1 | $3,000 | $110 |

| Credit Card 2 | $5,819 | $150 |

| Student Loan | $28,000 | $400 |

| Auto Loan | $4,879 | $210 |

| Borrowed from Parents | $1,500 | $120 |

| Payday Loan | $750 | $750 |

Meanwhile, although you can list all debt manually, a more practical way is to use an online calculator. This type of platform automates calculation, especially for complex ones.

Using an online debt list

Why are online calculators much more practical and functional than manually listing all debts?

A more detailed debt list using an online calculator

| Debt | Balance Owed | Interest (APR) | Minimum Payment |

|---|---|---|---|

| Mortgage | $170,000 | 6.4% | $1,300 |

| Credit Card 1 | $3,000 | 12.7% | $110 |

| Credit Card 2 | $5,819 | 9.7% | $150 |

| Student Loan | $28,000 | 5.4% | $400 |

| Auto Loan | $4,879 | 4.1% | $210 |

| Borrowed from Parents | $1,500 | 0% | $120 |

| Payday Loan | $750 | 30% | $750 |

| Debt Overview | Details |

|---|---|

| Total balance owed | $212,448.00 |

| Total monthly minimum payment | $3,040.00 |

| Average interest rate | 6.48% |

| Longest debt to clear/months | Mortgage/225 |

- Automate computations. Financial matters like a working payment plan involves calculations, and estimates may need complex formulas. Online tools like a debt list calculator helps. For example, in a functional debt list, the average interest rate includes the loan weight factor for each debt, not just the average of the total amount of interest.

- Visualize debt assessment. Debt calculators are designed to present figures in a neat and organized list. You can check out these items and start making payment decisions immediately at first glance.

- Intuitive, functional interface. There are different formulas to make your debt payment plan as functional as possible. A good calculator website will plot all these into different interfaces, so you can do all the computations you need in just one list. Aside from average interest rates, you can get your DTI ratio, amortization schedules, and other debt-related results from good online calculators.

- Helpful tips. A functional debt calculator website also works as an all-in-one information center. You can definitely check for other features like the most current interest rates, loan APRs, and such. There are also calculator websites that fully understand what a debt is all about and post helpful tips and ideas on related topics.

Choosing the most practical payment method

By listing the important details of each debt, you can now choose how to pay off your obligations. Two of the most common payment methods that financial observers say work with managing debt are the snowball and avalanche methods.

Both methods work with the debtor making the minimum payments for each debt, and paying extra on top of the required amount. However, each plan differs on what debt to prioritize.

In the debt snowball method, you’d need to pay off obligations based on the balance, with the extra payments made on the smallest debt first. Once this obligation is settled, you’d then roll over the succeeding payments as extra amounts for the next debt on the list.

Payment priority using debt snowball method

| Debt | Amount Owed | Interest (APR) | Minimum Payment |

|---|---|---|---|

| Payday loan | $750 | 30% | $750 |

| Borrowed from parents | $1,500 | 0% | $120 |

| Credit card 1 | $3,000 | 12.7% | $110 |

| Auto loan | $4,879 | 4.1% | $210 |

| Credit card 2 | $5,819 | 9.7% | $150 |

| Student loan | $28,000 | 5.4% | $400 |

| Mortgage | $170,000 | 6.4% | $1,300 |

Using the same list, with an extra $300 as additional payment, the payday loan will be paid off after just one month.

The original list notes the mortgage is paid off after 225 payments. In the snowball method, it will only take 79 months, 146 payments earlier than scheduled. The method also saves at least $81,600 in interest costs.

Meanwhile, the debt avalanche or stacking method puts the highest-interest debt on top of the list. While paying the minimum amounts for each debt, the highest-interest one gets the extra payment.

Payment priority using debt avalanche method

| Debt | Amount Owed | Interest (APR) | Minimum Payment |

|---|---|---|---|

| Payday loan | $750 | 30% | $750 |

| Credit card 1 | $3,000 | 12.7% | $110 |

| Credit card 2 | $5,819 | 9.7% | $150 |

| Mortgage | $170,000 | 6.4% | $1,300 |

| Student loan | $28,000 | 5.4% | $400 |

| Auto loan | $4,879 | 4.1% | $210 |

| Borrowed from parents | $1,500 | 0% | $120 |

With the avalanche method and the same $300 extra payment, paying off all debt will still take 79 months. However, instead of the mortgage, the student loan will be the last one to be cleared. The method will save you at least $82,700 in interest costs.

Each method has its own advantages for a debtor. If you are someone who needs constant motivation in pursuing a goal, use the snowball method. Settling small debts gives you regular wins and the feeling of satisfaction grows as each obligation is paid off.

If you are confidently familiar with all your debts, and most of your high-interest ones have long-month terms, the avalanche method is the most practical. Paying off high-interest debts will result in higher extra payments for succeeding obligations.

Practical debt management

Most often, people think of credit counseling as something only professionals do – technically, it is. However, the right attitude and making useful decisions also work towards getting out of debt. You can have a practical, DIY debt payment plan with some useful tips and ideas.

- Create a monthly payment calendar. Once you have selected which payment method to use, combine it with a monthly payment calendar so you always pay on time and keep track of debt. Paying on time means you save money otherwise spent on late payment fees and penalties.

- Look for extra income. Optimize your payment method with extra amounts on top of the minimum – the higher the better. Aside from getting a second job, there are also other things you can do to generate extra income. Odd jobs, online freelancing, and such are some doable things to consider for extra income.

- Stick to the monthly budget. There are different budgeting methods to keep track of income and expenses. Whatever method you use, strictly sticking to the budget guards against unnecessary expenditure and “discretionary” spending.

- Avoid impulse buys. Although more of a psychological statement, it is also a practical tip that should become a habit to help lower your debt faster.

- Lower your bills. Aside from debt, utilities and other monthly bills count towards a large expenditure. Save by using your utilities and maintenance smartly. The money you save means extra funds for debt payments.

- Pay more than the minimum. While the priority debt gets the extra payment, paying on top of the minimum on other obligations even in small amounts also helps pay them off quicker. Most often, it also results in adjustments to interests or debt terms, which works to your advantage.

- Negotiate and ask for help. Often, debtors think that most companies are only in it for the business. While this may be true, they would want your business for a long time. For example, if you have been a consistent account holder for a credit card company for years, try to negotiate with them for lower rates at least until your card balance has been paid off. There are also some who offer debt payment solutions like balance transfer if you ask them.

Make debt work for you

With practical tips and plans on how to pay off your obligations, living a debt-free life is not impossible. However, debtors should keep in mind that even the most functional of tools or the most reasonable of ideas on debt payments are not quick-fix solutions. Patience, discipline, and effort are needed to get out of debt as soon as possible.

About the Author

Benjie has been a bookwork for decades. He believes that writing is a form of expression, and that connecting with readers means you’ve expressed yourself correctly. Writing mostly on tech and social media topics, he continues to win over readers across other areas, too – both to inform and engage. His works have appeared in news publications like Christian Today & on business sites like Freelancer.com.

When taking a break from writing, you’ll most likely come across Benjie in a quiet corner of a room browsing an eBook by Robert Kiyosaki or Napoleon Hill, or reading the latest from Tom Clancy or WEB Griffin. In his spare time he enjoys urban trekking & photography.