Should You Refi Your Mortgage? Calculate Your Savings Today

Boost Savings with Home Refinancing

Published October 7, 2019 by Benjie Sambas

Mortgage interest rates continue its downward trend. Homebuyers often take advantage of this development by refinancing their homes. A well-timed home refi often equals great savings. However, there are factors to consider before thinking of restructuring loans, as these details should be strictly scrutinized to guarantee that a home refi can optimize over-all savings.

Fast facts

Refinancing is one financial tool in the home loan industry that offers savings for mortgage takers. Most home loan guarantors like Fannie Mae and Freddie Mac offer refinance schemes aside from conventional loans. Other government-backed guarantors like FHA and VA also have refinancing services.

However, the Mortgage Bankers Association says refi applications will slowly decrease. Since most borrowers apply for refi when there is a decrease in interest rates, MBA’s Joel Kan says the current increasing rates will likely dissuade homebuyers into going for refinance options.

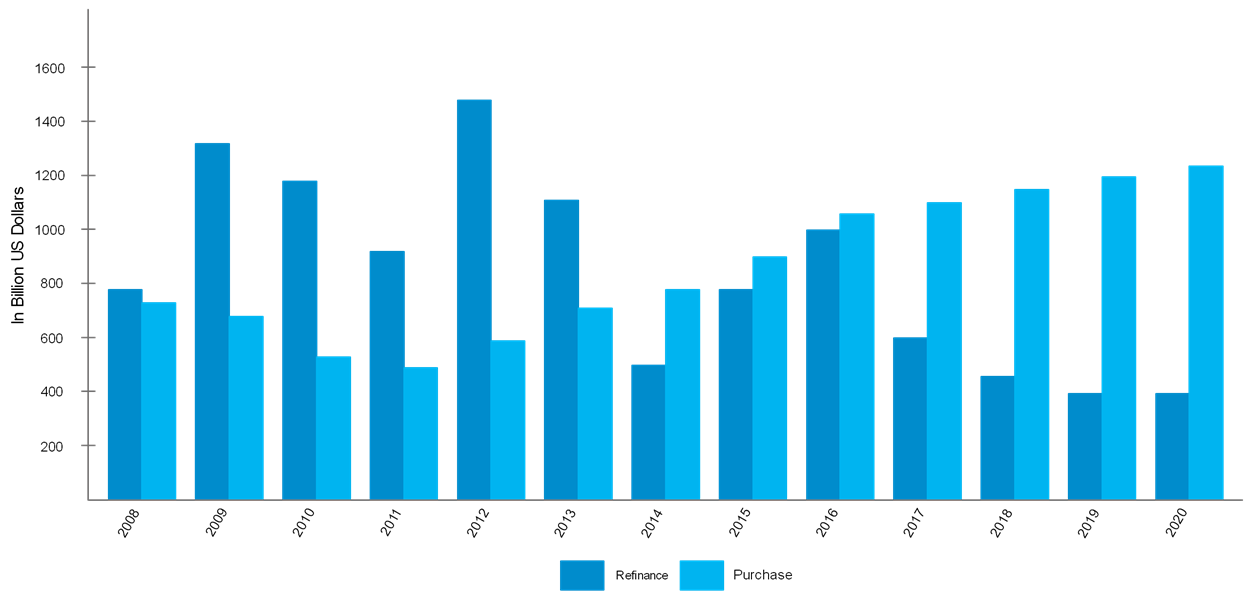

Mortgage origination forecast

“The 30-year fixed mortgage rate is expected to reach 4.8 percent at the end of 2018 and 5.2 percent by the end of 2019. This rising rate path is likely to cause refinance originations to continue to decline through 2020, as many borrowers have already refinanced in lower rate periods back in 2012-2013 and 2014-2016. There is a much lower incentive to refinance at current rates, unless there is a desire for a cash out refinance.”

Joel Kan, associate vice president of economic and industry forecasting, Mortgage Bankers Association

Even with decreasing numbers, those who avail of home refi can optimize loan restructuring to add to over-all savings or part of good financial management. This started as early as late 1990’s, as per the Federal Reserve. Data indicate that most homebuyers have taken advantage of lower interest rates during the period, as average rates substantially dropped by as much as 1.3 percentage points.

Why refi

Loan advisors say there are different – but common – reasons that most home buyers say when asked why they’re availing a refinancing scheme.

Lower interest rates.

The primary reason why refinancing is a good option to save is to take advantage of the difference in interest rates over the years. A decrease in rates mean lower monthly payments. However, most loan experts say that there is an optimal percentage point to keep in mind. A difference of at least 0.5%, with minimal closing costs, is the best deal to optimize savings.

Reduce payment amount.

There are also homebuyers who refinance even when there is minimal difference in interest rates. Rather, they restructure to get longer loan terms with lower monthly payments. There are those who use refinancing to save funds from the original amortizations and allocate it for newer purposes.

Decrease number of amortizations.

Meanwhile, there are some loan takers who want to pay off their mortgage as soon as possible. They apply for refinance to shorten the years to pay off. Although this may result in higher monthly payments, they can settle their loan in at least half the time it will take under the original terms.

Restructure for better terms.

Another common reason that homebuyers refinance is to negotiate for better terms. A continuing trend of decreasing interest rates may result in better finances when refinancing from a fixed-rate term to a hybrid ARM. Conversely, those who want to have stable, same-cost amortizations may opt to transfer their ARM loans into fixed-rate terms.

Rate-and-term versus cash-out

There are at least two options for refinance. The “traditional” form is mostly getting a new loan with lower rates. It’s up to the new agreement if there will be changes to the terms. Most homebuyers get the same loan terms especially if their primary reason for refi is to pay lower amortizations.

However, there is another type of refinance where loan takers can receive a lump sum aside from better terms. In a cash-out refi, applicants can restructure a loan with amounts higher than their outstanding loan balance. The difference between the new loan amount and existing balance gets taken out as cash.

A cash-out refi is different from home equity line of credit (HELOC). This type of loan guarantees against a home’s equity. Meanwhile, a cash-out refi works like a new loan with a higher amount.

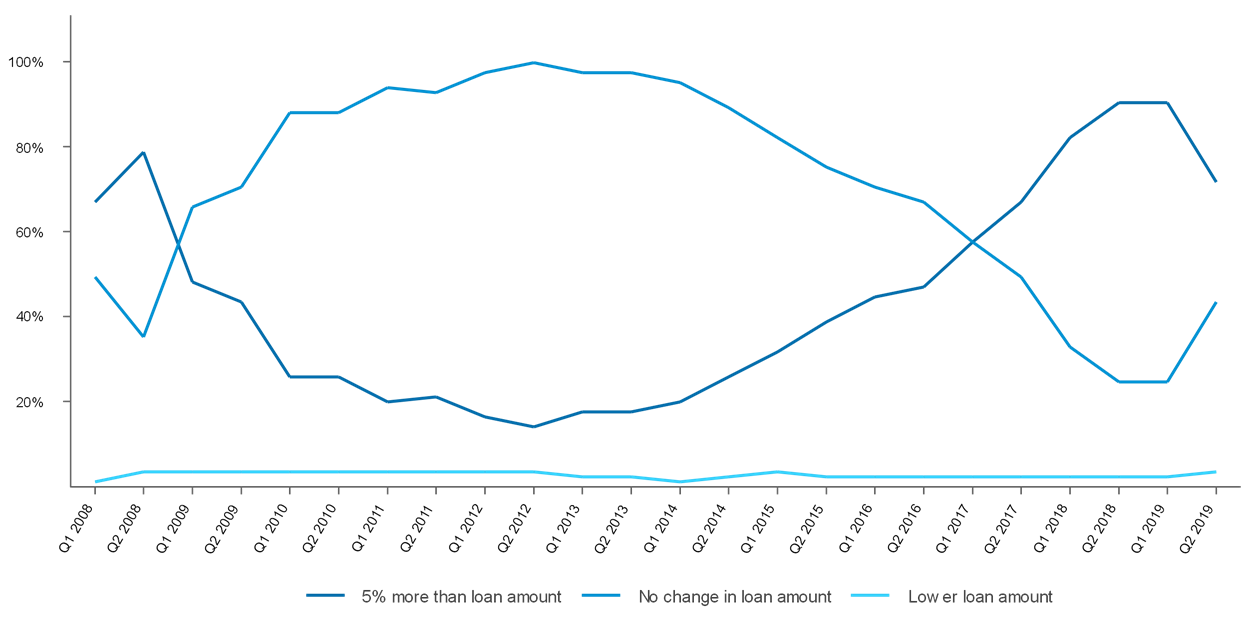

According to data from loan guarantor Freddie Mac, recent refi applications are cash-outs, with the new loans having 5% or more balance than the original one.

Q1 and Q2 refinance statistics from Freddie Mac

Why cash-out?

When used at the right moment, the advantages to getting a cash-out refi outweigh the upsides from traditional refinancing. Aside from quick access to extra funds, most cash-outs also offer better terms and loan rates. Additional advantages of cash-out refinancing include:

- Adding to home’s value.

Even if you are only taking advantage of lower rates, an additional upside of having extra funds is for equity investment. Some owners use the extra amount from a cash-out refi as home improvement funds. This way, you add more equity to your property. - Improve credit score.

Having extra funds from a cash-out can also improve credit score. When used as payments for high-interest debt like credit card bills, the funds help reduce your credit utilization ratio, which will eventually push your credit score upwards. - Get better terms.

In addition to the surplus funds, most cash-out refi give flexible terms and rates. This means that as a new loan, you can get shorter terms, which can increase monthly payments but close off the loan faster. You can also go the other way and choose a longer term with lower amortizations.

Other refi types

Rate-and-term and cash-out refinancing options are popular, but there are other refi structures that borrowers can also avail.

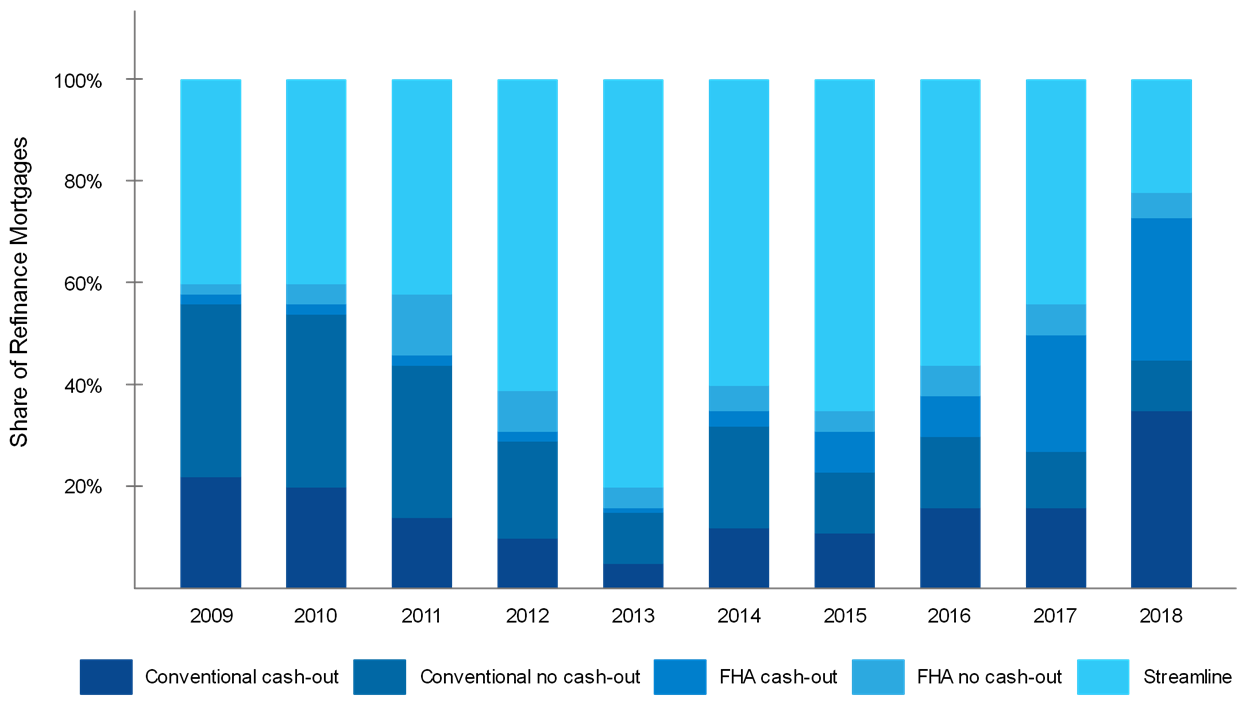

FHA endorsements by refinance type

Streamline refi

With most borrowers opting for refi schemes, lenders have made restructuring as painless a process as possible. Although considered as new loans, lenders mostly rely on the information and borrower details from the old loan agreement. This results in less requirements, paperwork, and fast-tracked steps. Known guarantors like FHA and VA offer this type of refinance.

Short refinance

This is an option for borrowers who have already defaulted on their payments. Instead of risking a foreclosure, lenders offer a short refi to pay off the entire mortgage. It avoids long, drawn-out processes associated with foreclosure. Borrowers can also apply for short refinance if the property’s price dropped, with the outstanding balance higher than the new market value. One downside for a short refi is that a borrower’s credit score may take a hit because of the lowered loan value.

Cash-in

The opposite of a cash-out refi, this scheme allows the borrower to pay down balance. This results in a loan restructure. Borrowers cash-in mostly to lower their loan-to-values ratio, so they can avail of lower mortgage rates. Another reason is to cancel PMI, which can further decrease amortizations.

IRRRL

Available for VA-backed loans, the Interest Rate Reduction Refinance Loan applies to VA to VA refi. There are also stricter requirements, such as previous occupancy of the property, limited amount of liability, and others. There is also a new funding fee paid at closing.

When to consider home refinancing

Restructuring an existing loan is helpful in getting additional savings. However, there are reasons to consider when is the best time to apply for a refi.

Improved credit score.

Since a refi is essentially a new loan, you can get better terms when you have improved your credit score. Although interest rates may have gone down, you are likely to get almost the same rate as the old one if your credit score dropped. You may even get higher rates than before especially if your credit rating has dropped significantly because of too much debt.

Interest rates become upsides long-term.

For example, it might be the time to refi to a hybrid ARM from a fixed-rate term if your advisor guarantees ARM rates will continue to be low. However, most experts say that rule of thumb for both rate-and-term and cash-out refi options is at least 0.5% difference over a long period to optimize refinancing.

Planning to stay for long.

Refinancing is a downside for owners who are not planning to stay long in their properties. As this process includes closing costs and other fees, they may have to pay more than the funds they’re thinking of saving in a refi.

Major improvements are needed.

When properties need major repairs and maintenance, a cash-out refi is one available option to optimize interest rates. You are likely to get a higher amount when refinancing than when applying for a separate loan.

Refi checklist

As with other financial tools, getting a refi means undertaking steps before approval. As a new undertaking, most loan requirements also apply for home refinancing. Eligibility is still measured even for fast-tracked options like streamline refi. However, there are some items borrowers need to take note of, especially if there are changes in their personal details like credit score, debt-to-income ratio, and other financial metrics.

Property value

Since the property was previously appraised to get the LTV for the original loan, most lenders check for the property’s new value. Housing prices may have increased or decreased in the property’s area, and this can affect a refi application since lenders will likely reject refinances with unfavorable LTVs.

Convenience

While there are mostly advantages to refinancing, especially for cash-outs and streamline restructuring, borrowers need to evaluate each time they refinance. Too much refinancing can result in higher loan debt. Most mortgages only pay off the interest in their early years. This means that for every refinance, only a minimal amount goes towards the principal.

Prepayment penalties

Ask your lender if there are early payment charges before applying for a refi. Some lenders charge for prepayments (different from closing costs), which can offset the savings you can get from a loan restructure.

Closing costs

Borrowers often mistake a refi to be an added duration for an existing loan. However, a refi pays off the original loan becomes a new mortgage. This means that closing costs are once again included in computations. Some borrowers neglect this detail. Closing costs are usually between 3% to 6% of the new loan’s amount. Most likely, loan takers for cash-out refi get surprised with higher closing costs than what they’ve originally paid for.

Counties with highest and lowest average closing costs

| County | Average Total Closing Costs without Taxes | Average Total Closing Costs with Taxes | Percentage of Sales Price |

|---|---|---|---|

| Kings, NY | $7,480 | $39,352 | 4.09% |

| Queens, NY | $6,784 | $28,729 | 4.44% |

| Washington, DC | $5,696 | $24,617 | 3.87% |

| Richmond, NY | $5,684 | $23,662 | 4.08% |

| Westchester, NY | $6,336 | $19,173 | 2.64% |

| County | Average Total Closing Costs (same costs with and without taxes) | Percentage of Sales Price |

|---|---|---|

| Jasper, MO | $1,689 | 1.21% |

| Jefferson, MO | $1,693 | 1.78% |

| Boone, MO | $1,716 | 0.80% |

| Jasper, IN | $1,793 | 0.99% |

| Clark, IN | $1,805 | 0.97% |

Average closing costs for some counties. New York area has the highest average closing fees, while at least three counties in Missouri have the lowest closing costs.

In conclusion

Aside from taking out a new one, a refinance is another option to pay off an original loan while saving money in the process. There are many advantages why a loan restructure may work. However, borrowers need to thoroughly check details on a refi to guarantee that they optimize the savings they get from a home refinance.