Lifetime Earnings Calculator Calculate Your Total Wages from Employment

Retire Comfortably Through Smart Saving

Published September 25, 2019 by Benjie Sambas

With increasing costs of living, saving for post-work years is not as convenient as it used to be. With expenses adding up, but without job-related income, a decent-sized nest egg is important to comfortably live after retirement.

However, there are different tried-and-tested concepts and ideas that turn into advantages toward building adequate retirement savings quickly, in as little time as possible.

Generations face savings crisis

Effective retirement planning is becoming a forefront issue. Majority of the workforce are already close to their retirement years. According to the Insured Retirement Institute, a leading financial services trade association for the retirement income industry, baby boomers are among those who admit they are totally unprepared for retirement. In a study, the organization found out that almost half (42%) of baby boomer respondents have nothing saved for retirement. Meanwhile, only a quarter of them believe that they can live adequately off their retirement income. This may be because majority of those close to retirement say they can live off their Social Security when the time comes.

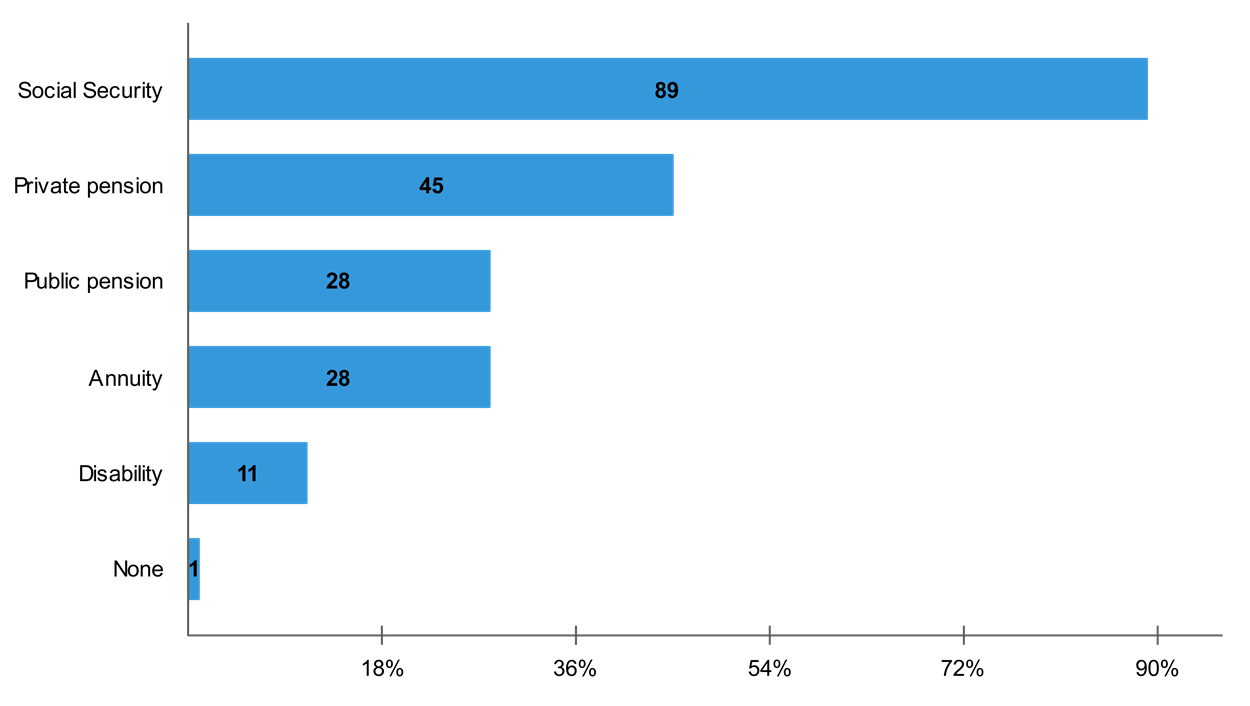

Expected sources of guaranteed lifetime income

Most people close to retirement age rely on Social Security for their guaranteed income once they retire. (Insured Retirement Institute)

Most people close to retirement age rely on Social Security for their guaranteed income once they retire. (Insured Retirement Institute)Although there are other sources of guaranteed income, those who are close to retirement are saying that Social Security will remain as their major source of income, with only a few relying on other income-generating plans like retirement DCs and personal savings.

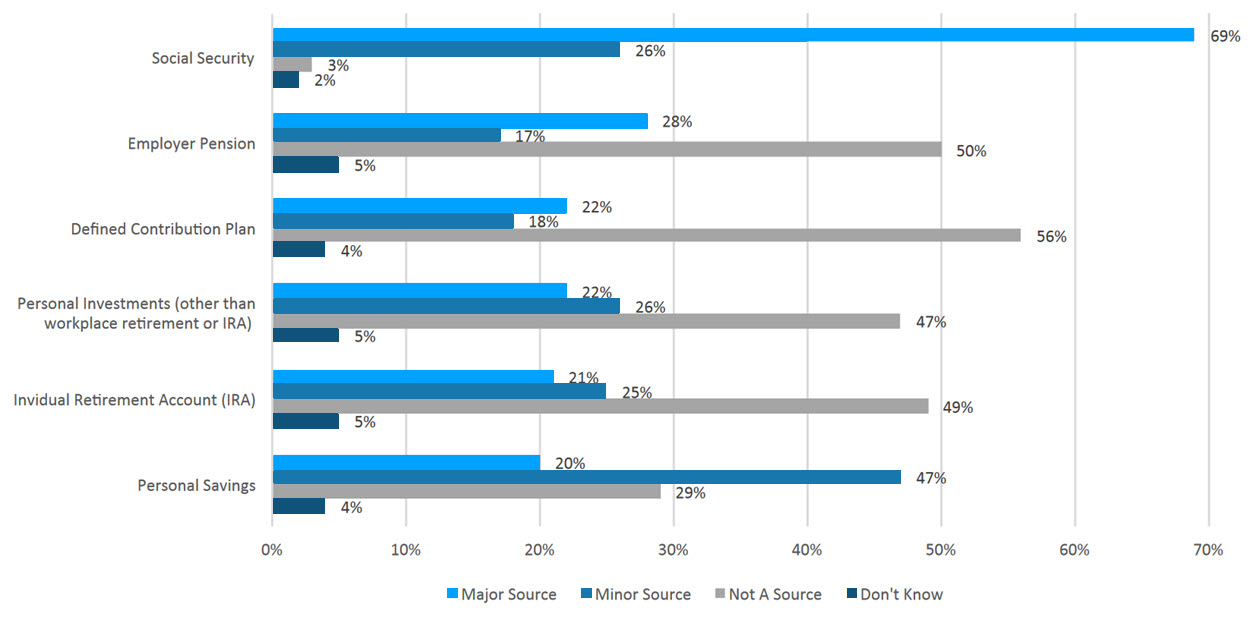

Importance of income sources in retirement

Relatively, Social Security is being considered as a major source of income in retirement. This is despite taxation on the program's benefits. (Insured Retirement Institute)

Relatively, Social Security is being considered as a major source of income in retirement. This is despite taxation on the program's benefits. (Insured Retirement Institute)This trend is particular among baby boomers, as some in this age bracket are already 70 and have retired. Additionally, almost 50 million in the age group will turn 65 over the next ten years.

Cathy Weatherford, President and CEO of the Insured Retirement Institute, believes that proper retirement planning should be made possible across all age groups, not just for those close to retirement. “Many Americans are simply not financially prepared for retirement,” Weatherford observes.

“Those who have not adequately prepared for a life without regular paychecks from employment must educate themselves, plan adequately, save as much as possible and consult financial professionals to create effective and realistic retirement strategies.”

Cathy Weatherford, President and CEO of the Insured Retirement Institute

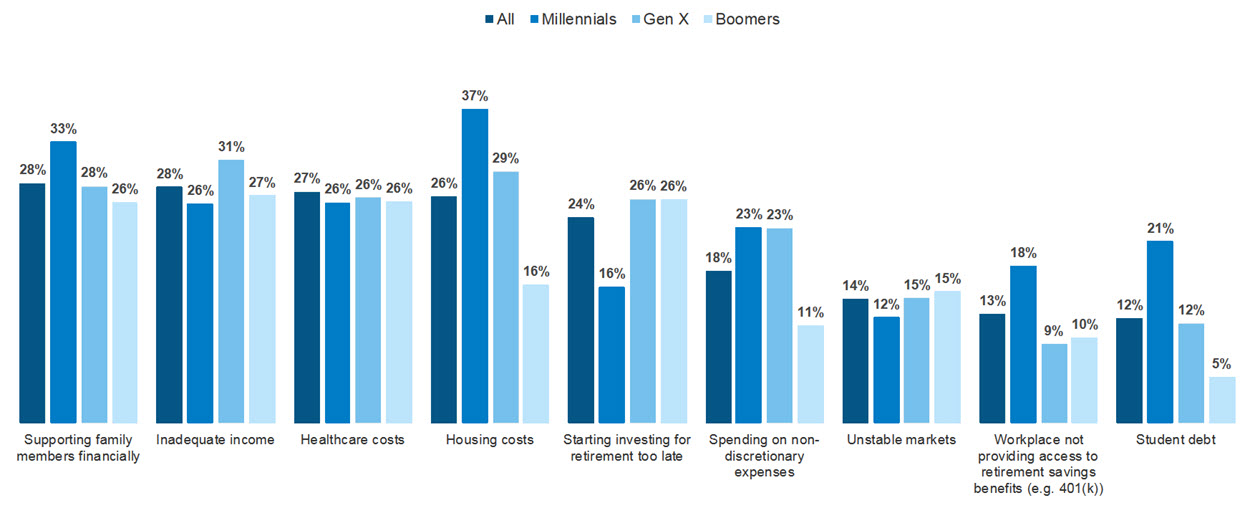

It's not only baby boomers who are having a hard time preparing for retirement. According to data from investments broker TD Ameritrade, millennials are also having retirement saving issues. Most of expenses like housing costs, healthcare, and family support are their burdens. Millennials have put saving for retirement as a non-priority in their income.

Reasons for inadequate savings

Millennials pour most of their income to housing costs, which include mortgage and other household expenses. (TD Ameritrade)

Millennials pour most of their income to housing costs, which include mortgage and other household expenses. (TD Ameritrade)Is $1 million enough for retirement?

Most believe that $1 million is already adequate for a retired individual to live comfortably.

| All | Millennials | Gen X | Baby Boomers |

|---|---|---|---|

| 58% | 59% | 56% | 58% |

However, current conditions like inflation rates, rising costs of living, and everyday expenses should be taken into account. Michigan, one of the states with the lowest housing and grocery costs in the country, would still set a retiree back about $55,500 a year to live comfortably for 20 years. At the other end is Hawaii, where an individual will need at least $2,500,000 for adequate retirement living for two decades.

Retire comfortably

Different factors like inflation, increasing costs of living, and everyday expenses are always present. This means that the value of an individual's income continues to diminish each year. This is also true with one's savings like their retirement funds.

A doable savings plan

In saving for retirement, smarter strategies are needed so you can build an adequate retirement fund for comfortable post-working years. One practical method is set a goal of 10 times the starting salary by retirement. Instead of setting an amount, the end goal for saving should be building up the fund with regular deposits. This should be achieved by 67 years of age. This is the age for full retirement based on Social Security standards.

Although a simple plan, saving regularly is a fail-proof plan that works. For example, with a starting salary of $46,500 annually (based on median income data from Bureau of Labor Statistics), this is how the plan works.

| Age | Savings Goal | Savings Goal Amount |

|---|---|---|

| 30 | x1 of salary | $46,500 |

| 35 | x2 of salary | $93,000 |

| 40 | x3 of salary | $139,500 |

| 45 | x4 of salary | $186,000 |

| 50 | x5 of salary | $232,500 |

| 55 | x6 of salary | $279,000 |

| 60 | x7 of salary | $325,500 |

| 67 | x8 of salary | $372,000 |

The target amount is not reached. Retiring at 67 would have only saved as much as 8 times the salary. Meanwhile, consider the following:

| Age | Savings Goal | Savings Goal Amount |

|---|---|---|

| 21 | x1 of salary | $46,500 |

| 25 | x2 of salary | $93,000 |

| 30 | x3 of salary | $139,500 |

| 35 | x4 of salary | $186,000 |

| 40 | x5 of salary | $232,500 |

| 45 | x6 of salary | $279,000 |

| 50 | x7 of salary | $325,500 |

| 55 | x8 of salary | $372,000 |

| 60 | x9 of salary | $418,500 |

| 65 | x10 of salary | $465,000 |

By starting right out of college, savings goals have been reached at least two years earlier than the retirement age. Continued direct deposits will add two more years' worth of savings. At 67 years of age, the total savings will be $558,000.

Smarter saving

Setting a goal like ten times the salary by retirement seems to be an impossible goal. However, it can be reached by saving 20% of the income per month. With focus and discipline, this is a realistic and doable plan. Meanwhile, smarter ideas and practical saving methods can further increase these savings or add funds for retirement in as little time as possible.

The power of interests

One common method is to open a regular savings account, where interest rates add more to the balance. There is increase in your personal savings because of the added interests. At 1.90% simple APY compounded daily, if your deposit reaches $46,500 at age 21, it will accrue interests. Meanwhile, since most banks compute interests on new balance, this means that continuous deposits will earn bigger interests.

The amount you need to save to reach each age's savings goal decreases since the deposits gain interests. With more gains, you get to save higher than your target amounts at given age intervals. By age 65, your savings will be significantly higher and may even breach the half-million mark.

Get high-yield instruments

There are also different financial instruments you can use to further increase your savings or shorten the time you need to reach your savings goal. Some accounts give higher returns as compared to others. Study and identify which of these different accounts or programs you can take advantage of to get the highest yields.

For example, there are savings accounts from online banks that give as high as 2.25% APY. This means that with simple interests compounded daily, a starting deposit of $46,500 will grow to $47,546.25 just after one year. With a high-yield online savings account, you'll reach the next rung in your savings goal faster.

Change saving strategies

With the inflation rates going up every year, you're likely losing money even when it is deposited in a savings account. It will be harder to reach your savings goal if you only consider direct saving methods to fund your retirement.

Experts recommend that to make savings work, people need to save into accounts with high returns. You can quickly build your post-work income with mixed saving methods. Aside from high-yield online savings account, you can build your savings from other instruments like certificates of deposit (CDs), US Treasury securities, and others.

Diversify

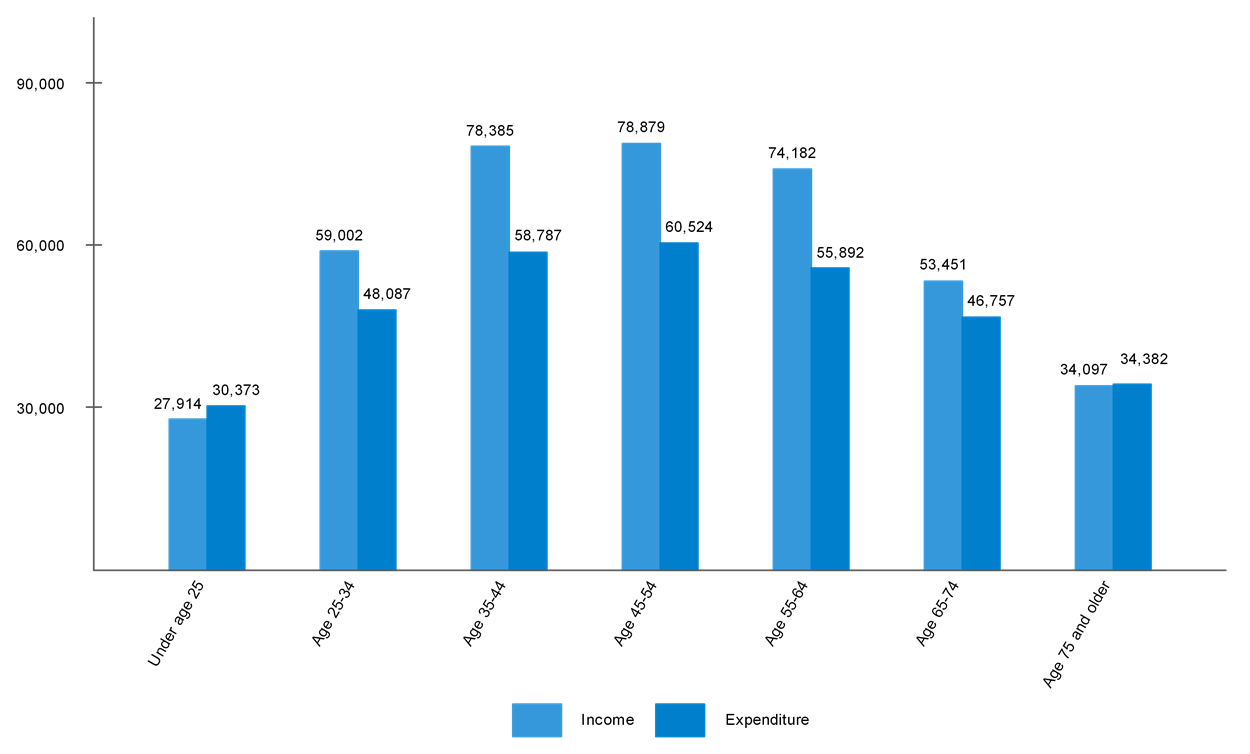

As people age, so should their saving habits. Income and expenses vary depending on the worker's age. According to the Bureau of Labor Statistics, income and expenses reach their peak from ages 45-54 and decreases as age increases.

Income and expenditure by age groups

Among the working age groups, income and expenses are in their highest during the middle working years. (Bureau of Labor Statistics)

Among the working age groups, income and expenses are in their highest during the middle working years. (Bureau of Labor Statistics)This means that aside from starting young, people should also adapt their saving methods to build decent-sized post-work income before they retire.

Catching up on my long-term retirement savings is completely possible

| All | Millennials | Gen X | Baby Boomers |

|---|---|---|---|

| 68% | 72% | 65% | 68% |

I will be able to retire at 65 or earlier / I already retired at 65 or earlier

| All | Millennials | Gen X | Baby Boomers |

| 64% | 62% | 52% | 71% |

Most millennials believe that they can retire by age 65 or earlier. However, most in the age group also thinks saving for retirement is not a priority during younger years. This mindset should be changed. Starting a retirement fund as early as possible is one of the best options to get comfortable in retirement.

Adapt long-term investments

Directly putting money into saving instruments work during the younger years since most millennials save for short-term goals. Although younger workers are expected to contribute more to household obligations, they still save regularly especially for personal goals. This is already a step in the right direction. Decent-sized deposits done regularly will likely develop into good saving habits which pay off in the long run.

However, while directly saving money into accounts is a convenient and safe option, diversified methods are likely to give better returns. This is important, since expenses, inflation and other factors are devaluing income. This means that putting all your retirement funds in a 2% APY savings account is impractical as a long-term goal.

Some employees in their middle years want to build their retirement funds faster. They need to adapt their saving routines and think of long-term gains. This is why some of the more experienced individuals explore aggressive financing like high risk-high return investments. Adapting a diversified portfolio is also one of the smarter approaches towards practical saving.

Some common accounts in a diversified portfolio include:

Defined contribution plans

Employees who have already worked for years are already eligible for most employer-matching and sponsored plans. Use this to your advantage and reach funding goals quicker. Instead of just putting retirement funds in a single savings account, max out a 401(k) or IRA for better gains. There are also specialized retirement plans like Roth IRA and Roth 401(k) that gives tax advantages.

Certificates of Deposit (CDs)

For investments that sacrifice flexibility for higher returns, CDs are one of the popular instruments. Unlike regular savings, this account works as a time deposit. The longer the terms, the higher the yields. Most CDs have 3- or 5-year terms and can go longer. However, there are also 1-year certificates of deposit, though they give lower rates.

US Treasury securities

Another financial instrument that sacrifice flexibility for high rates is US Treasury securities. One added advantage of these instruments is stability, as they have the full backing of the government. This means that there is no risk at all of lost investment. Treasury securities can be in T-notes, T-bonds, or T-bills. Each instrument offers different maturity terms and return rates.

Money market accounts

These work much like regular savings accounts, with notable differences. MMA interest rates are higher. They can also write checks, unlike regular savings. MMAs are also insured by the FDIC or NCUA, if the account is with a credit union. However, money market accounts need a maintaining balance to earn higher interests. In addition, you can only do 6 transactions per month. As a long-term fund builder though, MMAs can be a viable option to regular savings.

Boost income and earning potential

Aside from smarter saving approaches, another guaranteed method of quickly building a decent retirement fund is to increase cash inflow. This means generating new income or applying methods that increase the earnings potential and adds more to the retirement fund.

Max out 401(k)

One advantage of a 401(k) is that it is a company-sponsored plan. This means that many employers are matching employee contributions. Workers can take advantage of this upside with maxed-out contributions. Combined with making an early start, years of maxed out contributions means big retirement benefits from the account. 401(k) also have tax advantages, especially for its designated Roth account. A Roth 401(k) gets its funds from after-tax income, so gains from this account remain tax-free. This means more funds for retirement distribution.

Roll-over to an IRA

Bureau of Labor Statistics data show that baby boomers hold an average of 12 jobs during much of their working years. Meanwhile, most people think that when changing employers, they can either leave their 401(k) or withdraw their contributions. However, there is another option that gives higher chances of better returns. By rolling over their 401(k) into an IRA, workers can maintain a tax-advantaged status if funds are coming from a Roth 401(k). They also retain control of the investment options and can invest as they see fit.

Transfer a 401(k)

Again, instead of cashing out, there is another option to optimize a 401(k). Most employers allow a transfer of retirement plans. This means that if the new company's DC plan seems to return higher gains, you can elect to move your old 401(k) into a new one and just let the plan administrator manage it.

Increase income

Increasing monthly earnings doesn't mean quitting work and looking for a better-paying one. In the digital age, there are different approaches to expanding your cash inflow. Getting a second job is already a norm. There are even those who hold more than two jobs at a time. In addition, different side hustles are already available online. This means additional income without sacrificing too much time and effort.

Manage spending

While technically not adding income, learning how to cut back on needless spending will increase the value of your personal earnings. With most of the income focused on funding necessary expenses, there will be an excess which can be saved to continue building your retirement fund.

Plan a no-worry retirement

While the right mindset towards building a decent-sized nest egg for retirement is important, there are also other factors like the right approach and smart methods one can do to quickly build a good-sized retirement fund that will last for years of comfortable and enjoyable post-work living.

About the Author

Benjie has been a bookwork for decades. He believes that writing is a form of expression, and that connecting with readers means you’ve expressed yourself correctly. Writing mostly on tech and social media topics, he continues to win over readers across other areas, too – both to inform and engage. His works have appeared in news publications like Christian Today & on business sites like Freelancer.com.

When taking a break from writing, you’ll most likely come across Benjie in a quiet corner of a room browsing an eBook by Robert Kiyosaki or Napoleon Hill, or reading the latest from Tom Clancy or WEB Griffin. In his spare time he enjoys urban trekking & photography.